Bonus Depreciation 2024 Senate

Bonus Depreciation 2024 Senate

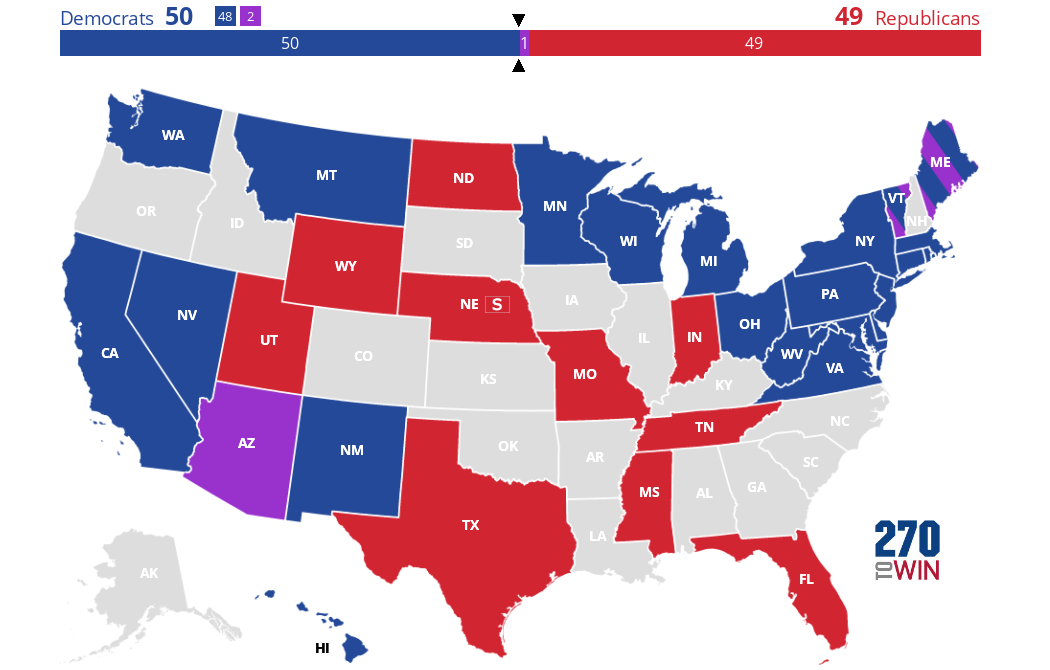

7024, which includes 100% bonus depreciation and other tax benefits for businesses, is unlikely to pass this year, as the. Both parties seek to gain strategic wins, leaving the bill's fate uncertain before the april 15th deadline.

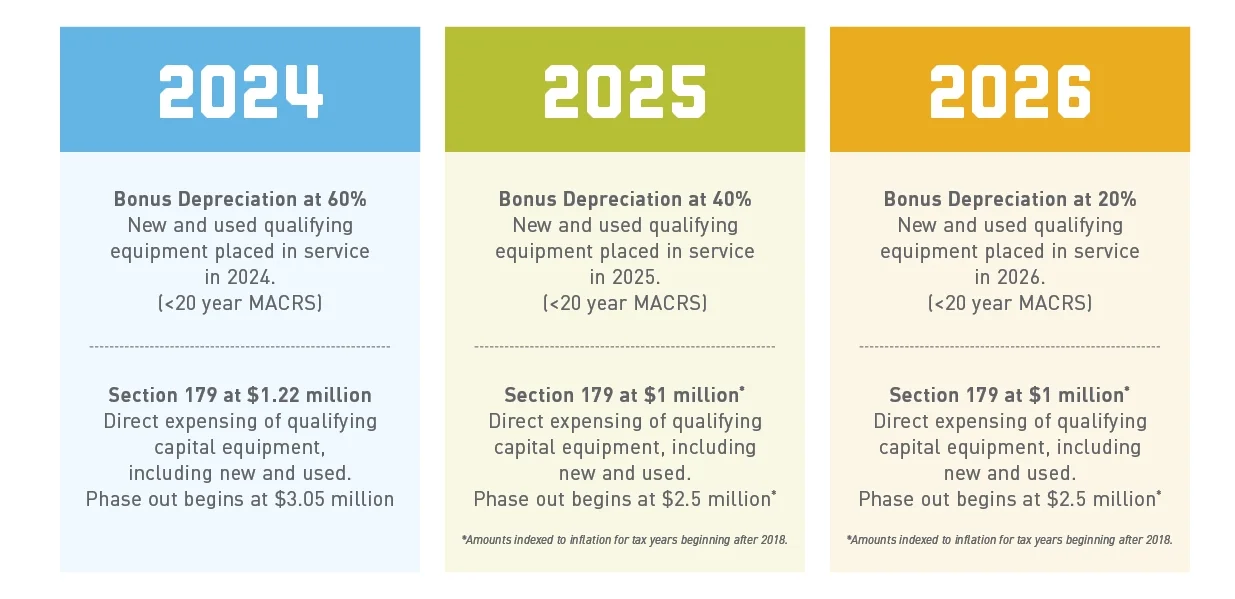

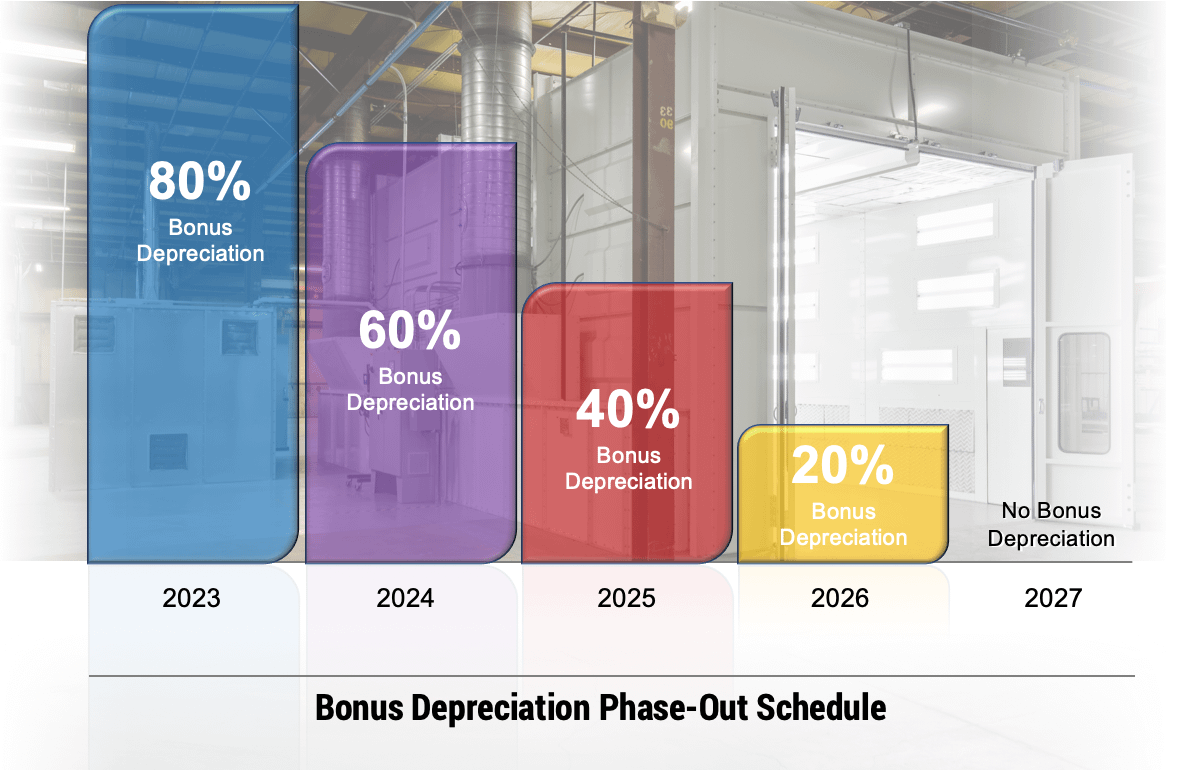

Without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024. It also extends the100% bonus depreciation through 2025, and increases the code sec.

The 2017 Republican Tax Law Cut The Value Of The Deduction For R&Amp;D Beginning In 2022 And Bonus Depreciation Beginning In 2023.

It also extends 100% bonus depreciation and increases the limitations on expensing of depreciable business assets.

7024, The Tax Relief For American Families And Workers Act Of 2024, Which Includes 100% Bonus Depreciation, As Well As Research.

The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft.)

Images References :

Source: investguiding.com

Source: investguiding.com

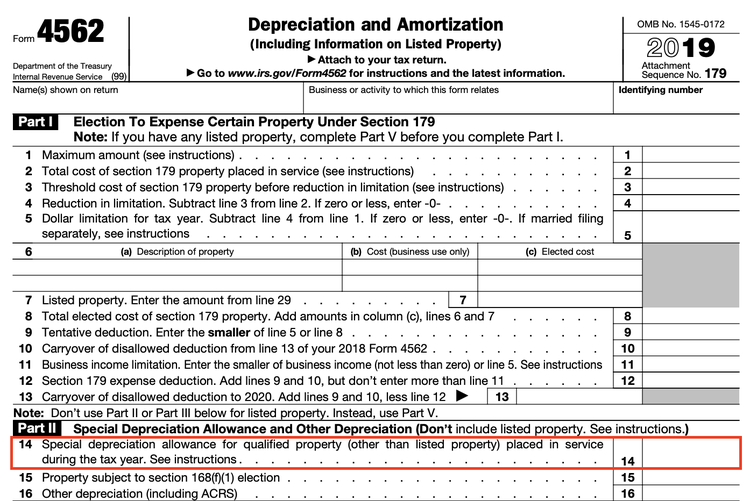

Bonus Depreciation vs. Section 179 What's the Difference? (2024), Faa reauthorization act of 2024. The title extends the allowance for depreciation, amortization, or depletion in determining the limitation of the business interest deduction.

Source: www.agdirect.com

Source: www.agdirect.com

Section 179 Update, The title extends the allowance for depreciation, amortization, or depletion in determining the limitation of the business interest deduction. Faa reauthorization act of 2024.

Source: www.fool.com

Source: www.fool.com

What Is Bonus Depreciation A Small Business Guide, 31, 2022, and before jan. The 2017 republican tax law cut the value of the deduction for r&d beginning in 2022 and bonus depreciation beginning in 2023.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft.) The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft [1].) this change may.

Source: globalfinishing.com

Source: globalfinishing.com

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation, Faa reauthorization act of 2024. According to the treasury, 3.8 million small businesses claimed bonus depreciation or the r&d deduction in 2021.

Source: www.asset.accountant

Source: www.asset.accountant

Section 179 Depreciation and Bonus Depreciation USA, 1, 2027, for longer production period property and certain aircraft.) increased expensing of depreciable business assets. The title extends the allowance for depreciation, amortization, or depletion in determining the limitation of the business interest deduction.

Source: ivetteqagnella.pages.dev

Source: ivetteqagnella.pages.dev

Bonus Depreciation 2024 Devi Henryetta, 1, 2027, for longer production period property and certain aircraft.) increased expensing of depreciable business assets. It also extends 100% bonus depreciation and increases the limitations on expensing of depreciable business assets.

Source: www.270towin.com

Source: www.270towin.com

Introducing the 2024 Senate Interactive Map 270toWin, The tax relief for american families and workers act of 2024, h.r. According to the treasury, 3.8 million small businesses claimed bonus depreciation or the r&d deduction in 2021.

Source: about.bgov.com

Source: about.bgov.com

Balance of Power in the Senate Bloomberg Government, Increased expensing of depreciable business assets. Pittman emphasized that “bonus depreciation is tied not to the taxpayer’s year but to the year the asset is placed in service.”

Source: www.heritage.org

Source: www.heritage.org

FY 2024 Senate Appropriations Fiddling While America Burns The, The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft [1].) this change may. 7024, which includes 100% bonus depreciation and other tax benefits for businesses, is unlikely to pass this year, as the.

Extension Of 100% Bonus Depreciation.

It also extends the100% bonus depreciation through 2025, and increases the code sec.

The Bill Would Make These Provisions Retroactive And Extend Them Through 2025.

According to the treasury, 3.8 million small businesses claimed bonus depreciation or the r&d deduction in 2021.

Category: 2024