401 Limit 2025

401 Limit 2025. Those who are age 60, 61, 62, or 63 will soon be able to set aside more money in a 401 (k). The limit on contributions will go from $22,500 to $23,000 next year, the company predicts, and says the same will be true for 403 (b) and 457 plans, the 401 (k).

Jun 25, 2024 11:13 am ist. More than this year, if one firm’s forecast is any.

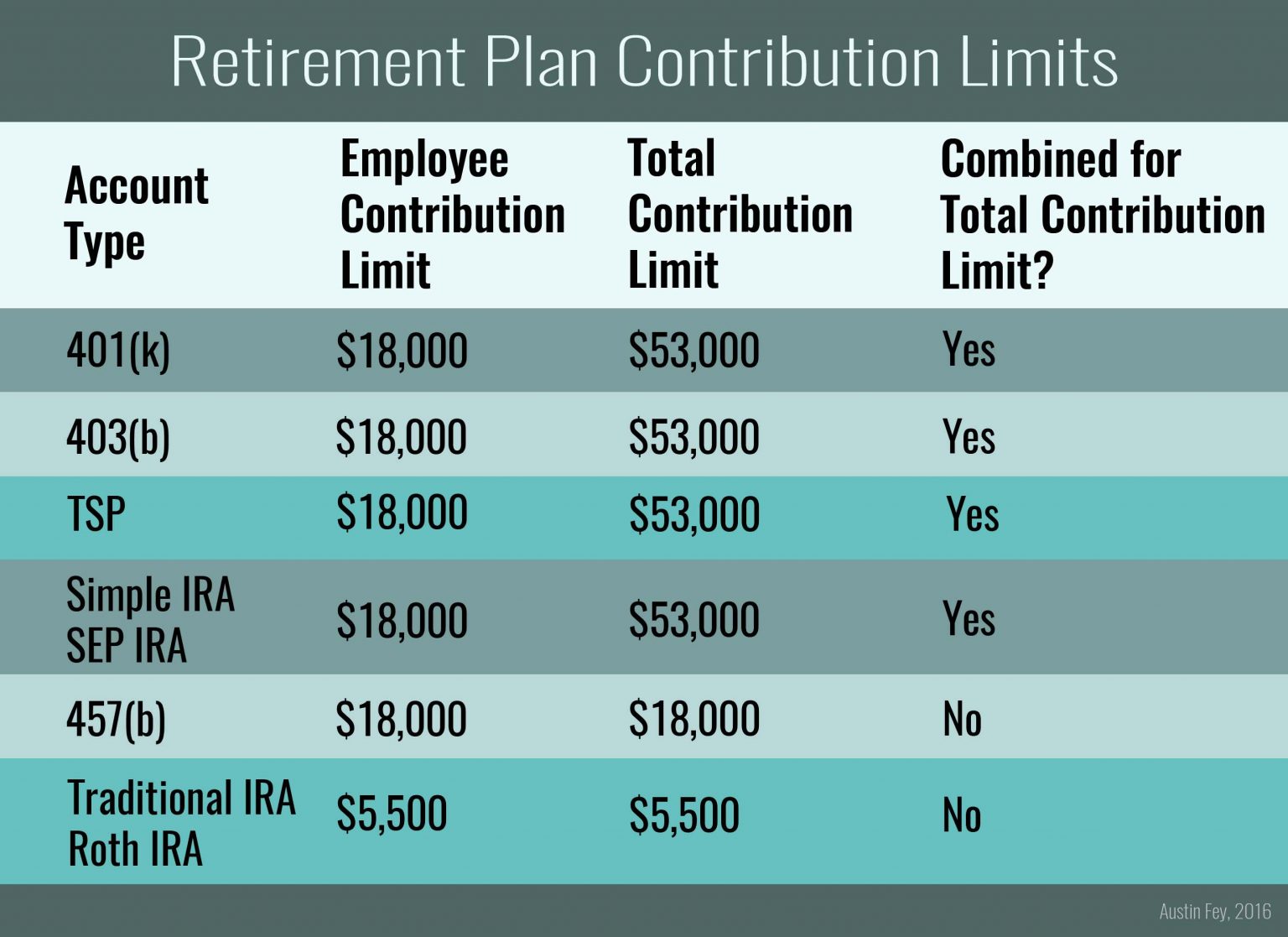

Additionally, The Total Contribution Limit.

For 2024, that limit is $23,000 for all but simple 401(k) plans.

The Increases Go Into Effect In January 2025.

You have no exemption left.

401 Limit 2025 Images References :

Source: www.blogto.com

Source: www.blogto.com

Ontario is permanently raising the speed limit on parts of the 401 and, That's an increase from the 2023 limit of $330,000. Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi).

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Actuarial consultant milliman predicts a $1,000 increase in the 401 (k) elective deferral limit for 2025, raising it to $24,000, and a $2,000 rise in the total. There are both individual 401 (k) contribution limits as well as aggregate ones, which include both your and your employer's contributions.

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, Most people don't max out their 401(k). That's an increase from the 2023 limit of $330,000.

Source: www.onplanefinancial.com

Source: www.onplanefinancial.com

What Is A 401(k) Match? — OnPlane Financial Advisors, For 2024, the elective deferral limit increased by $500 compared to 2023. How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025?

Source: www.kiplinger.com

Source: www.kiplinger.com

401(k) Contribution Limits Rising Next Year Kiplinger, For 2024, that limit is $23,000 for all but simple 401(k) plans. For example, suppose you gift $7 million in 2024 when the individual limit is $13.61 million.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2024 Meld Financial, For example, suppose you gift $7 million in 2024 when the individual limit is $13.61 million. That's an increase from the 2023 limit of $330,000.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, Here’s a look at the. There are actually multiple limits, including an individual.

Source: madelynwalisa.pages.dev

Source: madelynwalisa.pages.dev

401 Contribution Limits 2024 Over 50 Daron Emelita, You have no exemption left. Those who are age 60, 61, 62, or 63 will soon be able to set aside more money in a 401 (k).

Source: www.jackiebeck.com

Source: www.jackiebeck.com

401(k) Contribution Limits for 2024, 2023, and Prior Years, The 401(a)(17) annual compensation limit applicable to retirement plans increased from $330,000 to $345,000. In 2026, the limit drops to $7 million.

Source: jesselynwsalli.pages.dev

Source: jesselynwsalli.pages.dev

When Will Irs Announce 401k Limits For 2024 Cindy Deloria, For 2024, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. The secure 2.0 act is a recently enacted significant piece of legislation that has brought about substantial changes to the retirement account rules in the united states.

That's An Increase From The 2023 Limit Of $330,000.

The legislation requires businesses adopting new 401 (k) and 403 (b) plans to automatically enroll eligible.

See The Chart Below For Further Details For The New 2024 Limits, As.

The 401 (k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.